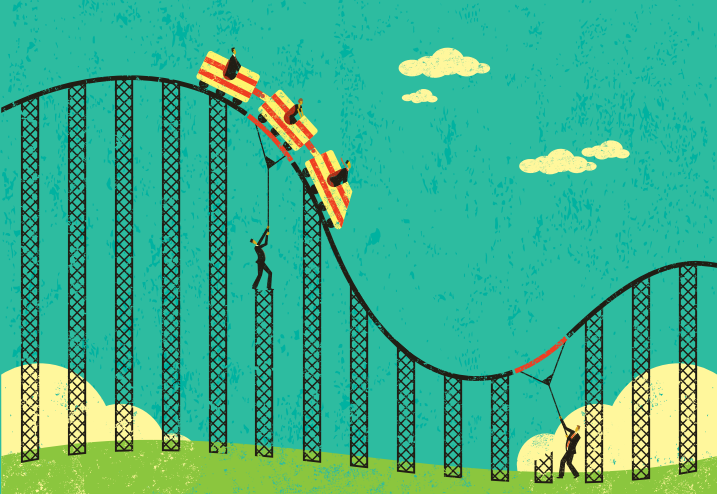

Income in peaks and troughs

If you have a variable income that ebbs and flows in peaks and troughs it can be hard to stick to a budget and you may be caught out with unexpected expenses. How can you plan for that?

There are many forms of variable income which may apply to retirees, self-employed people, shift workers, freelancers, contractor, part time workers or holiday workers. The fluctuations can make it difficult to manage your finances month-tomonth and you may find yourself a bit short throughout the year.

If an unexpected expense arises, you might be scrambling around to get the money you need to pay the bills. This can be stressful to say the least, but we have some tips that you can follow that may help with your money management.

Start simple – a budget

Having a budget is crucial to ensuring you have enough money to cover your essential expenses and build up your savings. A budget tracks your spending and factors in your income (including income fluctuations), expenses and financial responsibilities. It may help you set limits for discretionary spending such as entertainment, eating out and unnecessary shopping – to help you stretch your income. Perhaps most importantly, it may stop you overspending on the months you have a higher income!

Plan for the unexpected

Everyone needs contingency funds to cover unexpected events such as unforeseen medical costs.

But having money tucked away for emergencies is even more important if your income is unpredictable. A contingency fund is designed to help you stay afloat during periods of little or no income.

Investment income

You don’t have to fully rely on your job or trade for income. If you have enough savings on top of your contingency fund, you may want to consider investing a portion of your money. Your professional financial adviser could recommend strategies to help you generate an income from your investments which can provide you with a safety net and a little bit more money to play with.

Don’t forget your retirement fund

You may not be considering retirement savings when you have a variable income, but it’s vital for your financial security. If you’re looking to bolster your superannuation account, the ‘catch-up’ scheme helps eligible individuals increase their super savings by allowing them to make catch-up concessional contributions.

You can ‘carry forward’ any unused concessional contribution cap amounts starting from the 2018-19 financial year for five financial year on a rolling basis.

You may use carried forward unused concessional contributions caps if you had a total super balance of less than $500,000 at the end of last financial year. These amounts can change year-to-year so it’s a good idea to check the rules with your financial adviser who can help you fully understand your contribution options.

Consider insurance

Consider taking out income protection insurance to protect you and your loved ones should a sudden illness or injury prevent you from earning an income.

Income protection insurance may provide a monthly income while you’re unable to work. But depending on your job, different types of income protection insurance have different benefits and employment requirements.

Speak to your financial adviser to see if such a policy might work for you or how you may tailor a plan to meet your income protection needs.