Knowledge centre

RI's Knowledge centre

Keeping up to date is important, so here's the news.

Major asset classes mostly delivered gains for the month of September, led by Australian small companies.

We look at the changes to super rates and rules from 1 July 2024, including the increase to the Superannuation Guarantee (SG) rate and super contribution caps.

May saw a rebound from April’s generally poor performance. Only global emerging market shares produce a materially negative return this month.

You may pay less tax when tax cuts take effect from 1 July. While the tax savings will depend on your circumstances, it’s important to think about the best way to use them.

April saw a reversal from March’s solid performance. Only Global emerging market shares and cash produced positive returns.

March was one of those rare month’s where all of the asset classes in this report produced positive returns. Interestingly, the returns for the 1 year to 31 March 2024 were also very good and all positive.

After a poor month for nearly all investments in October, returns during November and December were exceptional.

Senior Australians can earn more from employment to address cost-of-living pressures without impacting their pension payments.

After an excellent month in December, returns in January seemed to be somewhat subdued.

You might be wondering what to do with your cashflow given the recent rise in home loan interest rates.

After a poor month for nearly all investments in October, returns during November and December were exceptional.

After a poor month for nearly all investments in October, returns during November were exceptional strong.

During October, Global Share performance was poor. Global shares lost 1.0% on an unhedged basis, and lost 2.8% on a hedged basis.

During September, Global Share performance was poor. Global shares lost 4.0% on an unhedged basis, ..

During August, Global Share performance was mixed. Global shares gained 1.6% on an unhedged basis, but lost 2.2% on a hedged basis, due to a depreciating AUD relative to the USD.

During July, Global Share performance was favourable. Global shares gained 2.1% on an unhedged basis, and gained an even better 3.1% on a hedged basis, due to an appreciating AUD relative to the USD.

We all like a good cost saving tip, even if it is something we already know. It never hurts to revisit some top tips and take a look at our current situation to see if there are savings to be made.

We spend a lifetime generating wealth but few of us spend the time to ensure it’s passed on in the way we want it to.

Planning for a future where super is essential -but only one part of retirement planning –is where financial advice matters. Many people can manage single-focus decisions.

From 1 July 2022, if you’re a first home buyer you can release up to $50,000 (up from $30,000) from your voluntary super contributions to help you buy your first home. Under the scheme, voluntary concessional and non concessional contributions made on or after 1 July 2017 may be released from super to help you purchase your first home.

The unexpected events of the past few years have made financial protection a front of mind matter for most Australians. Now more than ever we appreciate that life does not always go the way we plan. Having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

Are you approaching retirement? Then chances are the funding of your lifestyle in retirement may be on your mind.

The last couple of years have been tough on a lot of people with the COVID pandemic throwing the world into chaos and taking a toll on our physical, mental, financial and emotional wellbeing.

New year is a great time for making lifestyle changes, however, for goals and changes affecting your financial health, there’s often no better time than when starting a new job.

With a few simple changes, you could set a good example for your children.

That means the longer you live, the more money you will need for your retirement. Whatever your plans, it’s vital you have a strategy in place so that you can build your retirement savings as much as you can before you retire.

Taking care of household finances can be time consuming and boring – and often people don’t know where to start.

As Financial Advisers we talk about superannuation a lot. So much so that it probably becomes a fuzzy word people don’t even hear any more. And the younger you are, the less interested you probably are.

We have a few months left before the busy Christmas and school holiday period is upon us, so now is the time to think about whether your financial plan needs to be reviewed in light of any changes to your circumstances this year, and if your Will is up to date and estate planning is in order.

It seems we are increasingly using apps in everyday life. Apps can help us manage certain aspects of our lives, tap into things that are of interest to us, or keep track of different goals.

Compared to other investment structures, super is widely considered to be one of the most tax effective investment structures available from a wealth accumulation and cash flow generation perspective.

At some point you will retire. Many of us hope that is sooner, rather than later. We hope that we can retire with enough life left in us to enjoy all the things that took a backseat during our working years. We want enough money to be comfortable and safe in the knowledge we won’t run out of money and have to go back to work, unless of course we want to.

If you are in, or nearing, the retirement phase of your lifestyle you might be considering whether you want to stay in your current accommodation, or look for something to suit your needs as they change over the coming years.

In a year that has seen so many unexpected events take place it is top of mind for most Australians now more than ever that life does not always go the way we plan, but having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

Aged care is a complex and emotive topic and many people don’t think about their aged care needs until the time to do something is upon them – at which point the options can be limiting.

Have you made a big financial mistake in the past? One that cost you a lot of time and money to fix?

With the increased activity online – be it due to working from home, home schooling, or simply because we have found a great availability of engaging and interesting content and streaming services, we are online a lot more and need to consider if we are adhering to safe cyber practices at home.

Having an appropriate financial plan in place covers more than just investments and insurance. The same goes for a financial adviser – there are some you will just click with, who

Federal Budget Summary, The 2020 Budget is all about jobs, jobs and spending to make more jobs.

The increasing cost of goods and services is a reality most Australians have to deal with. Data from the Australian Bureau of Statistics shows that living expenses for employee households were up by 1.1% from March 2020, compared to March 20191. This may not seem like a lot, but if living expenses go up and wages stay stagnant, it makes an impact of your overall household income and expenses ratio.

If you are worried about the rising cost of living expenses and are not seeing any wage increases, then it’s time to get organised with your finances, set a realistic budget, work out what you can do without and where you can invest to save.

We hope that we can retire with enough life left in us to enjoy all the things that took a backseat during our working years. We want enough money to be comfortable and safe in the knowledge we won’t run out of money and have to go back to work, unless of course we want to.

Are you a new technology pioneer, or a proud ‘technophobe’? Wherever you sit on the digital spectrum, the transformative power of technology is undeniable. What’s important is how you harness it.

Investment results tend to vary more widely when you just consider the returns over a period of one year.

Making ‘catch-up’ contributions to your superannuation account can boost your savings for long term financial security.

According to a 2018 survey by research firm East & Partners for Scottish Pacific, nearly 80 per cent of small and medium enterprises (SMEs) said cash flow issues caused them the most sleepless nights, whilst a 2019 survey by the same group highlighted that the number of SMEs planning to borrow from their bank to fund business growth has halved in the past five years to 18.3 per cent.

If you have a variable income that ebbs and flows in peaks and troughs it can be hard to stick to a budget and you may be caught out with unexpected expenses. How can you plan for that?

We cannot control or influence curve balls life throws at us such as sudden trauma or loss, but we can protect ourselves from the impacts by having a sound estate plan in place and appropriate insurance cover.

If you have retired and think the days of reviewing your financial plans are over, think again. Now is the time to review your entire plan in-line with your new lifestyle and pay particular attention to any insurance cover in place.

Holidays should be a well-deserved break from worry. Here’s how to minimise your stress and have a relaxing time away.

Income protection, trauma protection, total and permanent disability insurance, life insurance...here is a summary of what each of these covers are, when you should get them and what the chances are that you'll need them.

Staying on top of finances can help couples achieve their shared goals. Whether they’re saving for a house or a holiday or seeking to grow or preserve their family wealth, setting up and sticking to a budget can help couples attain their common goals. By handling money well, they can avoid disagreements that could put a strain on their relationship. So how can people in a relationship keep their finances healthy? Here are some practical tips.

For many women, starting again after being left widowed or divorced can be difficult and overwhelming. Consider how good financial advice can make a real difference.

Having an appropriate financial plan in place covers more than just investments and insurance. The same goes for a financial adviser – there are some you will just click with, who can help improve your financial future.

Supporting your dependants doesn’t have to come at the expense of building your retirement nest egg.

If you are in your 40s and feeling like your financial fitness could do with an overhaul, then make 2020 the year to do it!

A goals-based investment approach isn’t focused on ‘beating the market’. It’s about tailoring your investments to meet your personal goals.

If you are in your 40s and feeling like your financial fitness could do with an overhaul, then make 2020 the year to do it!

There are many reasons for taking a break from the workforce: to have a baby, look after family members, or recover from a redundancy or illness. Whatever the reason, returning to work can be challenging. Here are some tips that may help give you the confidence you’re after.

Here are some tips on how to teach teens and young adults about money.

An increasing number of Australians are choosing not to spend their retirement at home. Instead, they’re setting off for adventures in the great outdoors. Could this be your dream retirement?

Just relax – it could save your heart. A recent study definitively linked stress with heart disease, but there are simple ways to de-stress and stay healthy.

Bills need to be paid even if illness or injury keep you out of work for any length of time.

New Year’s resolutions help you focus on what you would like to achieve in the coming year. Financial resolutions can be particularly beneficial, especially if you’re serious about following them through. Here are some suggestions to get you started.

Book a holiday, prepare for a sea change – but don’t forget your finances. Here’s what to consider when planning for your retirement.

Australia’s philanthropists are giving more than ever. So what motivates an individual to donate to charity, and how has our nation’s culture evolved as a result?

Would you like to supersize your super and take full advantage of all those lovely tax benefits that only super can offer? Who wouldn’t? The good news is there are plenty of ways to do this. If you know about them.

Nominating your super beneficiary is something you have most likely been asked to do if you have a superannuation fund.

The key to managing finances after a divorce is getting organised early. This article provides some tips on taking control at the right time.

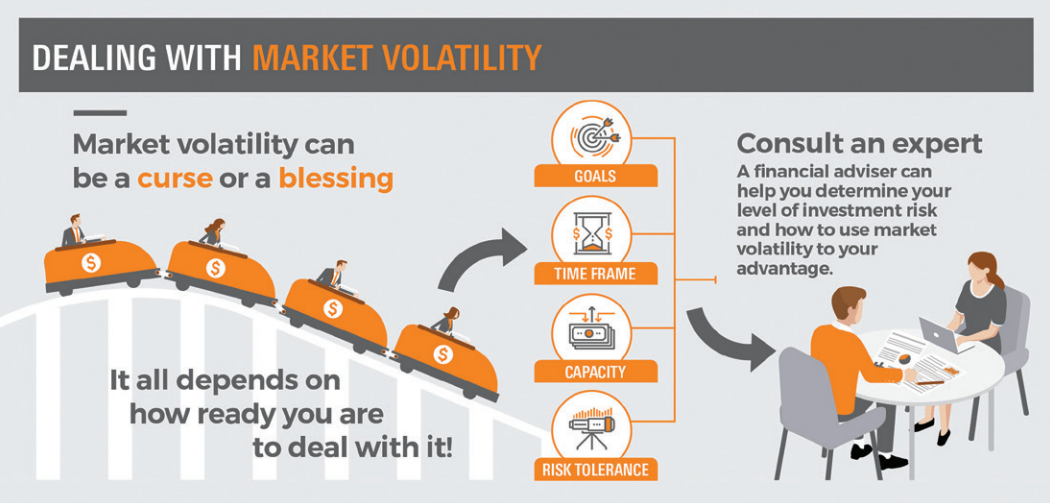

Market volatility can be a curse or a blessing. It all depends on how ready you are to deal with it.

Being in your 40s often involves balancing different priorities. For example, you may need to care for your ageing parents, grow your career or business, and if you’re a parent, support your children. With all these responsibilities, it’s easy to neglect your own financial wellbeing, including building your longterm savings. But it’s not too late to try secure your future. Here are some tips to help you financially make the most of your 40s.

One of the world’s most admired investors, Warren Buffett, is famous for saying “Don't save what is left after spending; spend what is left after saving.” While this approach may not always be possible, investing even just a small amount regularly can make a big difference over the long term.

Protecting yourself from frivolous creditors and lawsuits is becoming an increasingly common concern. Here we outline some of the ways you can insulate your assets.

An illness or injury can keep you from working and earning. Are you doing enough to protect your income if you’re unable to work?

Take the time to create a budget just for Christmas, so you can enjoy yourself without spending a fortune.

The bank of Mum and Dad has become an important source of funding for young Australians. Research has found that mums and dads are even helping their children to finance business startups.

As theft of financial data becomes more common, securing online accounts and personal information has never been more important.

Too busy to read a book? Learning about the powerful benefits of reading might convince you to make time.

Protecting yourself from frivolous creditors and lawsuits is becoming an increasingly common concern. Here we outline some of the ways you can insulate your assets.

One of the world’s most admired investors, Warren Buffett, is famous for saying “Don't save what is left after spending; spend what is left after saving.”

A goals-based investment approach isn’t focused on ‘beating the market’. It’s about tailoring your investments to meet your personal goals.

Having an appropriate financial plan in place covers more than just investments and insurance. The same goes for a financial adviser – there are some you will just click with, who can help improve your financial future.

Many Australians choose to work part time after retirement instead of hanging up their work clothes completely. Data from the Australian Bureau of Statistics shows that 34 per cent of full-time workers aged 45 or over intended to switch to parttime work before retiring. Some people choose to lessen their workload to help ease themselves into retirement. Others want a higher income than what they would receive if they left the workforce altogether. Whatever the reason, working doesn’t have to stop you from enjoying retirement. After all, you have paid your dues, and deserve some flexibility and recreation. Here are some ways to help make your semi-retirement more enjoyable.

As you near retirement, you may be considering what to do with the family home and if there are ways you can boost your superannuation savings. Downsizer super contributions may present an opportunity for you to divert savings into your super fund.

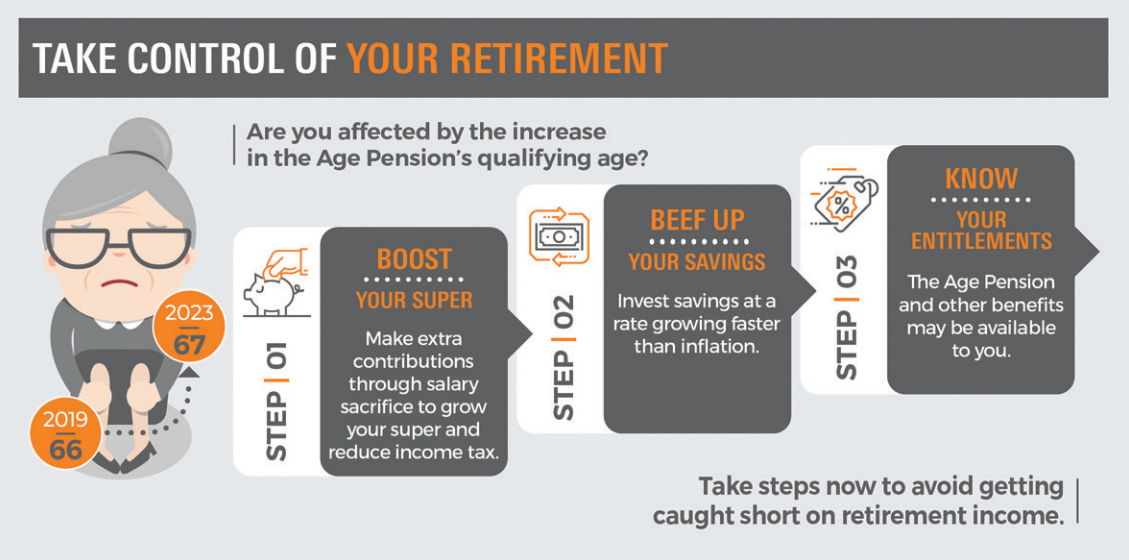

Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income.

For many women, starting again after being left widowed or divorced can be difficult and overwhelming. Consider how good financial advice can make a real difference.

Teaching your kids healthy money habits. With a few simple changes, you could set a good example for your children.

If you’re organised with your finances, the high cost of living doesn’t have to mean diminished savings.

In your 40s and still not financially secure? Don’t fret. You can still catch up.

Windfalls such as salary bonuses and inheritances are more common than many people think. An Australian survey showed that 85% of seniors are likely to leave an inheritance for their children, with an estimated $3.3 trillion pledged1.

Whether they’re saving for a house or a holiday or seeking to grow or preserve their family wealth, setting up and sticking to a budget can help couples attain their common goals. By handling money well, they can avoid disagreements that could put a strain on their relationship.

Life insurance policies don’t have to cost an arm and a leg. Here are tips for making them more affordable.

You need to be savvy to build a sufficient nest egg for retirement. Planning is key, and so is getting professional advice. Most Australians are not saving enough for retirement and risk running out of money sooner than they expect. Data shows that in 2015–16, Australians had average superannuation balances of only $270,710 for men and $157,050 for women at the time of retirement.1 These sums are significantly lower than the $545,000 that the Association of Superannuation Funds (ASFA) estimates singles need for a comfortable lifestyle in later years.

When things go wrong, it’s nice to know you’re covered. But getting suitable insurance cover can be a matter of getting professional advice.

New Year’s resolutions help you focus on what you would like to achieve in the coming year. Financial resolutions can be particularly beneficial, especially if you’re serious about following them through. Here are some suggestions to get you started.

Take a break – without breaking the bank Holidays should be a well-deserved break from worry. Here’s how to minimise your stress and have a relaxing time away.

It’s an important skill but many people are still not as financially literate as they should be. Here are some ways that may help you improve.

The urge to donate is strong in Australia, and it’s easy to make it part of your financial plan. An estimated 14.9 million Australian adults (80.8 per cent of the population) gave $12.5 billion to charities and not-for-profit organisations in 2015–16.

As kids grow older, their financial needs – and their opportunities – grow more complex. If you have done the groundwork and taught your children the benefits of budgeting and saving, it will be much easier to talk to them about managing their finances in their teens and beyond. Teaching good money management early will help them make informed financial decisions over the long term.

How to deal with market volatility Market volatility can be a curse or a blessing… It all depends on how ready you are to deal with it...

First-home buyers get some help State and federal governments are creating new incentives to help first-home buyers get into the overheated housing market...

Budget offers an incentive to downsize The 2017 Federal Budget encourages some older people to downsize from homes that no longer meet their needs to free up housing stock for young families...