Strategies for dealing with market volatility

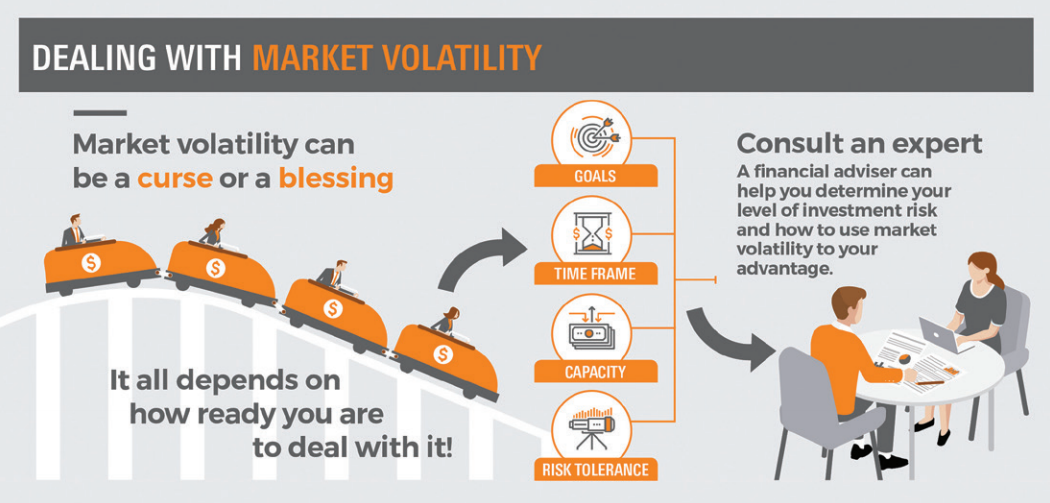

Market volatility can be a curse or a blessing. It all depends on how ready you are to deal with it.

Financial markets by their nature are volatile. However, the more worrying time for investors is during periods of high volatility when prices move rapidly and unpredictably.

While this can be concerning, a sudden drop in the market can have dramatically different implications for someone nearing retirement compared with a person just starting their career. This is why it’s important to have a financial plan.

Consult an expert

Professional plans are created in partnership with a financial adviser, who is trained to help you determine your investment goals, time frames, capacity and tolerance for risk, and appropriate types of investments.

In large part, dealing with volatility depends on how you view risk. Quite simply, risk relates to the variability of your investment returns in relation to your goals and time frame.

In other words, will you fret over a decline in value and sell your holdings to prevent further falls? Or will you remain unfazed and stick with your financial plan?

Threats can come from several areas:

- Operational risk – the way a fund is run

- Exposure risk – the perils of investing in a specific sector, industry or country

- Market risk – the extent to which prices move across the whole market

- Currency risk – the way in which exchange rates affect investments

- Inflation risk – how increasing prices will impact your returns.

Capacity for risk

For individual investors, though, there is a bigger consideration – your own capacity for risk. This covers not only how risk tolerant you are but also your stage of life. Together with your financial adviser, considering where you are in your life journey is critical in determining your plans and goals.

Risk capacity changes as, among other things, when you get married, change jobs, have children, buy a house, plan to retire or enter aged care.

Although market volatility is out of your hands, it may affect your personal financial situation.

Determining how to use it to your advantage is the key, but without advice, you may not even realise that changes or opportunities exist.

Talk to your adviser

An appropriate amount of risk in your investments may give you the confidence to stick with your financial plan even when the market takes an unexpected dip.

But a knee-jerk reaction may cause you to sell when prices are low, rather than hold onto an investment that may rebound and recover.

Regularly checking in with your adviser may help you keep your financial plan in sync with all the changes in your life.

Talk with your Financial Adviser who will work with you to develop a financial plan that’s specifically tailored to your needs.